The demand to substantially eliminate the 1,076 million tonnes (2018) of greenhouse gas (GHG) emissions, which includes carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O), expressed in CO2e[1] or CO2eq of total shipping (international, domestic and fishing) is often centred on assets like ships, engines, and alternative fuels. While these are valid considerations, it is essential to focus on the entire range of decarbonization enablers spread across clusters of value chains (VCs). The resulting holistic view avoids bottlenecks, gaps, and shortages. While many solutions are not yet financially viable and some may never be there are enablers that are already economical today, e.g., a shortening of ballast voyages. Enablers can become viable through technological maturity, mass adoption but also through regulation and a shift in economic value capture and distribution.

A VC-driven well-to-wake approach addressing lifecycle GHG emissions encourages the industry’s stakeholders to expand their vision and scope of decarbonization far beyond onboard fuel consumption. Shipowners, operators, and charterers (carriers) should account for upstream shipbuilding, fuel production and distribution, onboard and port equipment, and processes and GHG emissions, capturing all opportunities brought about by a full life cycle assessment (LCA). Along with this it is also vital to understand how much emission reduction or energy efficiency maritime shipping offers in a multi modal supply chain.

Building on the first article in the decarbonization playbook series and based on a multi-facetted study on decarbonizing shipping, we outline in this second article of a series of articles the scope of decarbonization in the maritime industry that implies a broader alignment and cooperation among all stakeholders involved across a cluster of three interdependent maritime VCs considering also conducive regulatory frameworks and incentives. Such collaboration across different stakeholder groups is a prerequisite for frictionless, effective, and efficient decarbonization. The wider thinking also includes adjacent clusters of VCs, like shipbuilding materials and refinery equipment VCs that support or reduce the maritime sector’s ability to decarbonize and vice versa.

A VC is a step-by-step business process that moves a product or service from idea to reality. Every step along the chain should add value. The value creation is generally accompanied by energy consumption in some form resulting in GHG emissions. Hence, we believe we should analyze VCs to drive decarbonization across the maritime sector and the general economy.

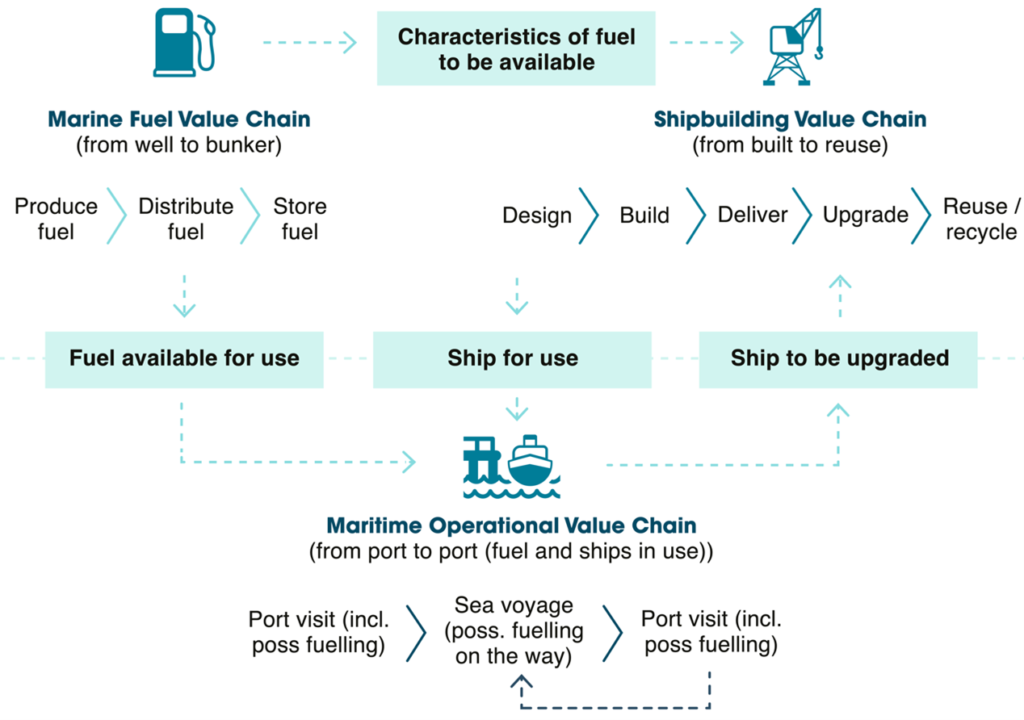

Three interrelated maritime VCs (Figure 1) are playing a critical role in decarbonizing shipping: marine fuel, shipbuilding, and maritime operational value chains.

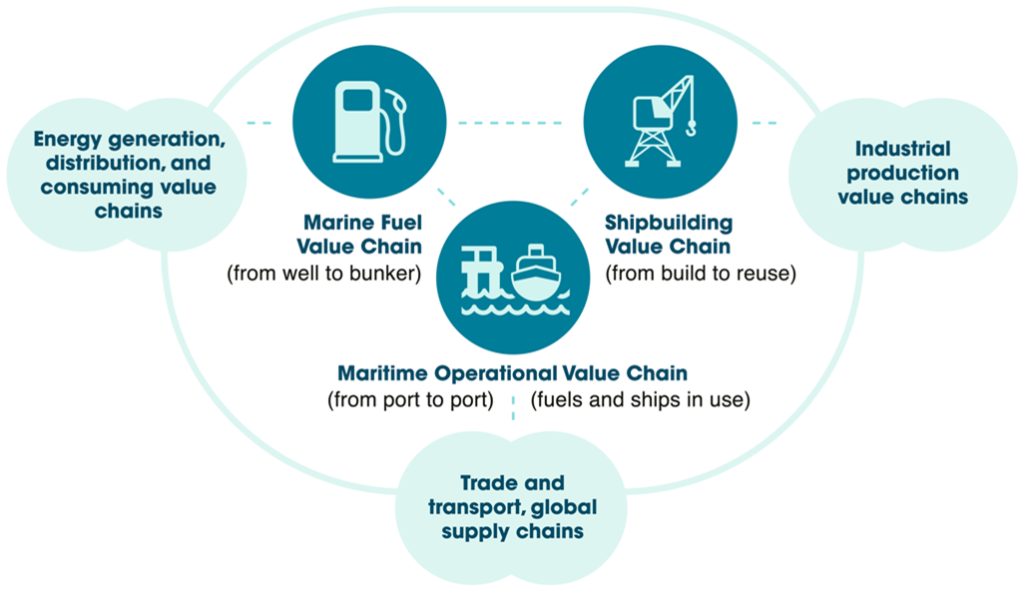

The three maritime VCs are interdependent (Figure 2). Achieving decarbonization efficiently means aligning supply and demand across this cluster of chains. The marine fuel VC needs to supply sufficient alternative (green) fuel at relevant refuelling locations to match the demands of alternative fuel. This requires information sharing, collaboration, and synchronisation of the development of each VC as well as an understanding of the characteristics and needs of different business models. For example, short-sea shipping might be powered by clean electricity or biodiesel, whereas ocean voyages may need green methanol or ammonia.

Figure 2: Interdependency between the value chains

The availability of alternative fuels is an essential ingredient for greener shipping. The vital suppliers of these fuels are production and processing technology providers, energy companies using these technologies, and the carriers that transports these fuels to where they are needed. The green energy transition shifts dependencies from fossil fuel producers to renewable energy providers. This may reduce the importance of some regions but will also bring new opportunities to other locations with possible shifts in geopolitical power.

Market structures will also shift. Whereas the current marine fuel market can be considered global in nature, prices for alternative fuel tend to vary much more between locations as the price build-ups differ substantially. According to practitioners around 10 percent of the end use price for today’s marine fuels stems from distribution and storage, whereas for alternative fuels the costs are significantly higher. Thus, we can expect that the current (somehow predictable) global fuel market will become more fragmented.

Considering the volume of marine bunker, today’s bunkering prices, and a hypothetical levy of $100 per ton of CO2, an estimate of the commercial value of the marine fuel VC based on its total annual expenditure is approximately $250 billion today[2], without factoring in the potentially higher costs and investments in alternative fuels.

The shipbuilding VC consists of ship design, procurement (e.g., steel), production (component production, assembly, and integration), and post-production (maintenance, repair, and reuse and recycling). The shipbuilding and marine fuel VCs are interdependent, and the respective shareholders should share their long-term investment and development plans to ensure alignment of supply and demand.

So far, the answers to three questions determined the shipbuilding process:

1) How much capacity of cargo / passengers is needed (i.e., size of ship)?

2) How fast should the ship travel (i.e., size of engine)?

3) How energy efficient should the ship be (e.g., hydrodynamically efficient hull and propulsion designs, or on-board wind power)

In future ship builders will also need to ask:

4) What fuel and quantity will be used (the answer impacts tanks, fuel feeding systems and engines)?

More energy-efficient new builds and retrofits will be needed to reduce GHG emissions from the existing and future shipping fleet. What ships and engines will be built and sustainably used largely depends on the assessment of what fuels will or can be available and their cost. But predictions on what is needed has become much harder. Shipowners need information from fuel suppliers on what will be available, in what quantities, and where and at what prices across the globe. What the industry probably needs to accept is that making accurate predictions for the lifecycle of a ship has become extremely hard as energy sources available for use will change over time.

The shipbuilding VC can be valued at $115 billion, based on the contract value for new orders placed in 2021.

The maritime operational VC includes fueling, provisioning, and cargo and passenger handling. Faster turnarounds raise capital productivity. Bunker locations, fuel prices, and weather conditions impact the routing, and, hence, operational efficiency. It is widely understood that there is plenty of room for efficiency improvement along this VC.

Steaming speed is an important factor; synchronization along the chain is critical. Technology provides solutions to improve fluidity and reduce costs and emissions. Optimizing the number of ship types in a fleet can reduce fuel consumption per transported unit. The long-tail of companies with only a few ships may face limits when trying to optimize ship and fleet size. Exploring multiple ways of optimization is necessary until the alternative marine fuel VC is sufficiently developed. Market-based measures (MBMs) should help to expand the fuel VC and support the mammoth effort of replacing the current fossil fuel-powered fleet with cleaner ships.

Simply put, there are three key performance indicators (KPIs) to watch to reduce GHG emissions along the ship operational VC:

1) Utilization rate of the space dedicated to cargo and / or passengers.

2) Economies of scale (i.e. use larger units to transport more cargo / passengers at once, where possible without lowering the utilization rate).

3) Speed: operating a ship at optimal design-speed.

Globally bulk carriers travel about 56% of the time in ballast, with a small or no payload. Thus, minimizing ballast voyages is crucial for reduced bunker consumption. Horizontal partnerships may help to increase ship utilization, e.g., through a shared pool of ships, and potentially consolidation of the industry may be conducive as well. Virtual arrivals driving better synchronization, for example, can minimize bunker consumption, but needs a strong commitment from ports and charterers. Solutions inevitably have trade-offs. For example, slower steaming with longer travel times means that more ships are needed to move the same amount of cargo; and expanded shipbuilding increases GHG emissions. A holistic approach is required to make optimal decisions across clusters of VCs.

Estimating an annual commercial turnover of the operational VC is difficult. The asset value of the world fleet, according to UNCTAD’s Review of Maritime Transport 2022 (forthcoming), stands at $1.4 trillion. Hence, the most value is in the operational value chain, also indicating the lion’s share of GHG emissions, followed by the marine fuel VC, and then the shipbuilding VC.

Today, the maritime industry burns fuel that hardly anybody else demands. Tomorrow, the sector will compete for feedstock of alternative fuels with other industries that also require low-carbon zero emissions solutions to decarbonize. The increased competition will likely raise prices until supply will have expanded, and thus creating challenges for many industries to reduce GHG emissions in the short to medium term. But synergies may also emerge. For example, short-sea ships and trucks can both run on biodiesel and may get clean fuel to a certain extent at seaports raising capital productivity of bunkering/fueling equipment. Electric vehicles may recharge onboard using a ship’s electrical system.

These new opportunities drive the need to expand the thinking about decarbonizing shipping beyond the cluster of maritime VCs to a larger decarbonization ecosystem that consists of adjacent clusters of VCs (Figure 3).

In the context of the broader ecosystem, new challenges need to be addressed by the public and private sectors.

With whom is shipping competing for green fuels and what does this mean for decarbonizing the maritime industry and the prioritisation of fuel development? What factors influence the costs of building green ships and hence their price and adoption? How can carriers be motivated to reduce their carbon footprint? What global trade and system dynamics need to be factored into the decarbonization calculus?

Decarbonization will remain slow until the global community has found answers to these questions or the elimination of GHG emissions has become a question of survival.

Behind each VC are actors. When considering the cluster of maritime VCs and its key players, from a ship owners’ practical point of view, beneficial cargo owners (BCOs) are the most visible part of the ecosystem, which consists of a number of interrelated clusters of VCs. BCOs are under pressure and will request from carriers the implementation of certain decarbonization measures with the other stakeholder across the maritime cluster of VCs following the carriers.

The majority of emissions, costs, and economic competitiveness is rooted in the operational VC, and not in processes such as shipbuilding, retrofitting, or repurposing. Though these are vital too. Parties deploying the vessel, whether for cargo or passengers, are the most critical drivers of the green transition in shipping. Even if alternative fuels are available and state-of-the-art shipbuilding processes are in place, the expected increase in costs of each critical maritime value chain during the transition period over the next years or even decades will need to be dealt with by the cargo owners and ultimately be absorbed by consumers, hopefully, eased by effective MBMs, sustainability policies, and so forth. Again, some of the solutions to reduce GHG emissions have already been economical for some time.

Time-charter is a significant part of the carrier market. Over time, the tightening of rules, regulations, and industry requirements will lead to a change in ships to be chartered, a greater share of ownership, and potentially horizontal collaboration to better use capacity. We see positive developments within the shipping industry, where cargo owners are joining forces with ship owners and green fuel suppliers, forming partnerships resulting in custom-built vessels, long cargo contracts, and bunkering infrastructure for future fuels in selected ports. Many new partnerships can be expected across industries and ecosystems.

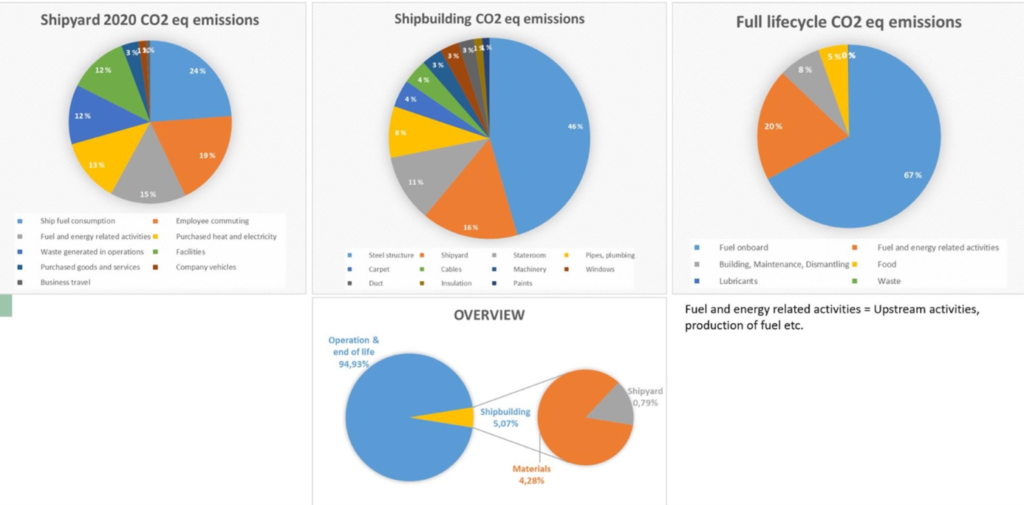

It is important to understand the distribution of CO2eq emissions across the three critical maritime VCs. Figure 4 depicts the repartition in cruise shipping.

Figure 4: Cruise shipbuilding value chain GHG emissions in relation to emissions from other value chains (Source: Meyer Turku)

The graph confirms that the lion’s share of emissions is generated by the operational VC, followed by the marine fuel and then the shipbuilding VCs. Such analysis empowers companies, irrespective of the VCs they are engaged in, to reduce GHG emissions in a systematic way considering the other parts of the larger ecosystem. Despite the variances in impact between maritime VCs each actor is requested to drive decarbonization with maximum effort to ensure that the industry reaches the IMO 2018 ambitions.

In June 2021 the International Maritime Organization (IMO) adopted the Energy Efficiency Existing Ship Index (EEXI); annual operational carbon intensity indicator (CII) rating and an enhanced Ship Energy Efficiency Management Plan (SEEMP) as short-term measures to reduce GHG emissions and carbon intensity from existing ships (shipbuilding and operational VCs). While EEXI is a measure of the energy efficiency of the technology and design of a ship, CII is a measure of the ship’s operational efficiency, or how efficiently it is being operated to transport goods and passengers based on the amount of fuel consumed in a year. This measure will impact all cargo, RoPax, and cruise ships above 5,000 gross tonnage trading internationally.

With these revised measures coming into force in 2023, the existing ships will be required to calculate their EEXI following technical means to improve their energy efficiency and to establish their annual operational CII and CII rating (from A to E). The rating thresholds will be increasingly stringent towards 2030 in line with initial IMO ambitions. CII will effectively provide a means for charterers to rank ships. The new regulation introduces increased and thus renewed interest from BCOS and consumers in the emissions produced in the VCs. The need to achieve the mandatory requirements will create pressure on various clusters of VCs. The associated impacts on other socio-economic aspects will be equally important, further justifying the need for an integrative and holistic approach.

A lack of clarity about impact and availability of decarbonization solutions, discourages many, in particular smaller carriers. The availability of alternative fuels (at the “right” quantity and price) should reduce the hesitation to invest in, e.g., lower GHG emissions engines and ships and stimulate their production. More research is required to cut through confusion and uncertainties.

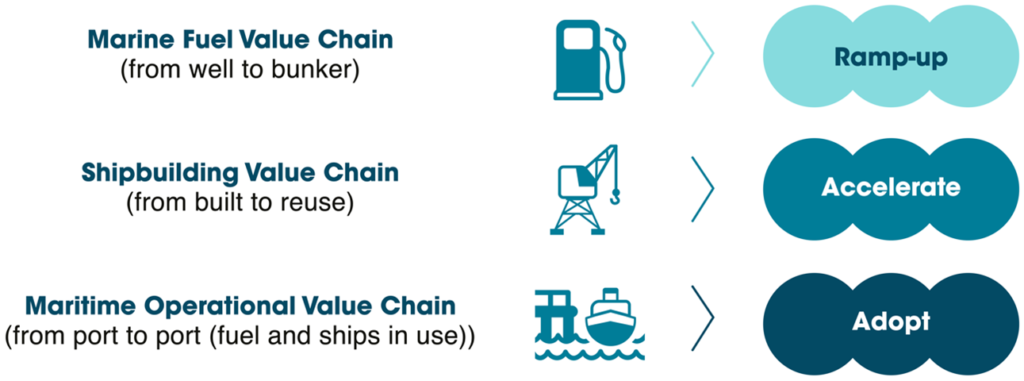

Decarbonizing shipping means decarbonizing VCs. An interdependent VC-perspective highlights the need for holistic cluster strategies based on identified gaps, bottlenecks, and shortages that cause imbalances and dysfunctions across the cluster (Figure 5). Tensions and synergies become obvious when applying a broader ecosystem view. A focus on clusters of VCs ensures that the different components are integrated, and developments are aligned. Cross-ecosystem initiatives will create opportunities for economic growth, jobs, cleaner air, mitigating risks linked to increased atmospheric GHG. A holistic approach and broader ecosystem thinking drives emissions-efficient operations (the maritime operational VC), production of alternative fuels (the marine fuel VC), and green shipbuilding practices (the shipbuilding VC) in a coordinated way.

This will likely drive partnerships further than ever before in the history of shipping. Simultaneously, many in the industry are in the midst of a digital transformation, introducing circular economy practices, and adjusting to new regulatory frameworks. Such a magnitude of change was probably last seen at the end of the great era of sailing ships. Proactive embracement of these changes is almost certainly a key determinant of survival. The early-movers who embrace this period of change will likely be the long-term winners.

This article was originally published by The Maritime Executive in August 21, 2022.

[1] CO2e is describing different greenhouse gases in a common unit

[2] Annual bunker: 229,000,000 metric tons as per Ship & Bunker

Average price per metric ton of VLSFO on 9 August 2022: $813

229 000 000 x $813 = $186,177,000,000

Add to this a possible levy of $100 per ton of carbon (e.g. Marshall Island proposal) with 3.15 tons of CO2 per ton of fuel

229,000,000 x 3.15 x $100 = $72,135,000,000

$72 billion + $186 billion = $258 billion

Written by: Mikael Lind, Wolfgang Lehmacher, Thomas Doepel, Jyrki Heinimaa, Jan Hoffmann, Mika Laurilehto, Manfred Lebmeier, Moritz Petersen, Ilkka Rytkölä, Jessica Saari, Sukhjit Singh, Riinu Walls, and Richard T. Watson

Mikael Lind is the world’s first (adjunct) Professor of Maritime Informatics and is engaged at Chalmers, Sweden, and the Research Institutes of Sweden (RISE). He serves as an expert for World Economic Forum, Europe’s Digital Transport Logistic Forum (DTLF), and UN/CEFACT. He is a well-recognized trade press author, the co-editor of the first two books of maritime informatics,and co-author of the recently released Practical Playbook for Maritime Decarbonization.

Wolfgang Lehmacher is operating partner at Anchor Group and advisor at Topan AG. He is the former head of supply chain and transport industries at the World Economic Forum and President and CEO Emeritus of GeoPost Intercontinental, advisory board member of The Logistics and Supply Chain Management Society, ambassador of The European Freight and Logistics Leaders’ Forum, advisor of GlobalSF, founding member of the think tanks Logistikweisen and NEXST, and co-author of the recently released Practical Playbook for Maritime Decarbonization.

Thomas Doepel is the COO and Deputy CEO of Finnlines Plc. With over 20 years of shipping experience and by combining his maritime knowledge with a broad economic insight through his Master Mariner, M.Sc. Economics and MBA studies, he has gained a deep understanding of the real key drivers in the shipping business and gained a good understanding of the fundamental business opportunities and risks.

Jyrki Heinimaa is former CEO and President of Rauma Marine Constructions, which is the Finnish network based shipbuilding company, and the chairman of board of Finnish Marine Industries Association, which association represents great number of Finnish marine industry companies, and is a member of board of SeaEurope.

Jan Hoffmann is Head of UNCTAD’s Trade Logistics Branch, which implements research and technical assistance programmes in international transport and trade facilitation. Previously, Jan worked for UN ECLAC in Santiago de Chile and IMO in London and Santiago. He holds a PhD in Economics and has held part time positions as assistant professor, import-export agent, and seafarer.

Mika Laurilehto is the interim CEO of Rauma Marine Constructions

Manfred Lebmeier is an environmental engineer who has worked for almost 10 years as senior environmental advisor for the Hamburg Port Authority. He is active in several international committees and working groups with the topics sustainability, climate change and decarbonization of ports and shipping in e.g. IAPH and ESPO.

Moritz Petersen is Assistant Professor of Sustainable Supply Chain Practice at Kühne Logistics University (KLU) in Hamburg. He is also the Director of KLU’s Center for Sustainable Logistics and Supply Chains. In his research, he focuses on decarbonizing the logistics industry and fostering the shift towards more circular economies.

Ilkka Rytkölä is a naval architect working as Program Director in Meyer Turku Shipyard in Finland developing climate neutral cruise ship and shipyard operations. Ilkka has worked with several ship types, products and solutions together with ship owners, shipyards, suppliers, universities, research institutions, and classification societies.

Jessica Saari, with a Master´s degree in Economics majoring in Operations & Supply Chain Management, is Business Development Director at Meriaura Ltd. Based on 10 years of experience in short sea shipping operations and sales, she is closely involved in the practical development of supply chains and the decarbonization of short sea shipping.

Sukhjit Singh is Head of School (Maritime Sciences) at the University of Gibraltar. He is actively involved in energy and safety management systems within the maritime domain, seeking to provide innovative solutions and mitigating emissions from ships and ports. He has worked on numerous capacity building projects promoting technologies and operations to improve energy efficiency in the maritime sector.

Riinu Walls, with an MBA degree in Maritime business, is Business Development Director, partner and Member of the Board at Meriaura Ltd. She has more than 10 years of expertise in short sea shipping operations and sales having a solid background for developing both environmentally and economically sustainable solutions.

Richard T. Watson is a Regents Professor and the J. Rex Fuqua Distinguished Chair for Internet Strategy in the Terry College of Business at the University of Georgia. He has published over 200 journal articles and written books on electronic commerce, data management, and energy informatics. His most recent book is Capital, Systems, and Objects.

Published by: Wolfgang Lehmacher, Board Member @ Wolfgang Lehmacher | Supply Chain, Logistics, Transport

Thank you for connecting with us. We are happy to hear from you. We’ll be in touch soon to schedule a time to understand your goals and present how the Symphony Logistics solutions optimises the business for every enterprise.